Building a high-dividend yield portfolio requires a strategic approach and keen attention to market trends. Investors seeking steady income from their investments often turn to dividend-paying stocks as a reliable source of passive income.

By selecting a diverse range of companies with a history of consistently paying dividends, investors can create a portfolio that generates consistent cash flow and potential for long-term growth. In this article, we will explore the key principles and strategies to consider when constructing a high-dividend yield portfolio that aligns with your financial goals and risk tolerance.

Understanding High-Dividend Yield Investing

To effectively build a high-dividend yield portfolio, it is essential to understand the concept of high-dividend yield investing. In simple terms, high-dividend yield investing involves selecting stocks that pay out a higher dividend relative to their share price.

This can be an attractive strategy for investors seeking regular income from their investments, as dividend-paying stocks can provide a steady stream of cash flow. However, it is important to note that high-dividend yield investing also comes with risks, as companies with high dividend yields may be struggling financially or have limited growth potential.

Therefore, it is crucial for investors to conduct thorough research and analysis before adding high dividend stocks to their portfolio to ensure a balanced and diversified investment strategy. By understanding the nuances of high-dividend yield investing, investors can make informed decisions and potentially achieve their financial goals.

Selecting High-Dividend Stocks for Your Portfolio

Selecting high-dividend stocks for your portfolio can be a daunting task, but with careful consideration and analysis, you can build a robust and reliable investment strategy. When looking for high-dividend stocks, its important to focus on companies with a history of consistent dividend payments and sustainable growth potential.

Additionally, consider the dividend yield, which is the percentage of the stocks price that is paid out as dividends annually. Look for stocks with a high dividend yield relative to their price, but be cautious of companies with unsustainable dividend payouts that may not be able to maintain their high yields in the long term.

Diversifying your portfolio with a mix of high-dividend stocks from various industries can help mitigate risk and maximize potential returns. Conduct thorough research and consult with financial advisors to ensure you are selecting the best high-dividend stocks for your investment goals.

Diversifying Your High-Dividend Portfolio

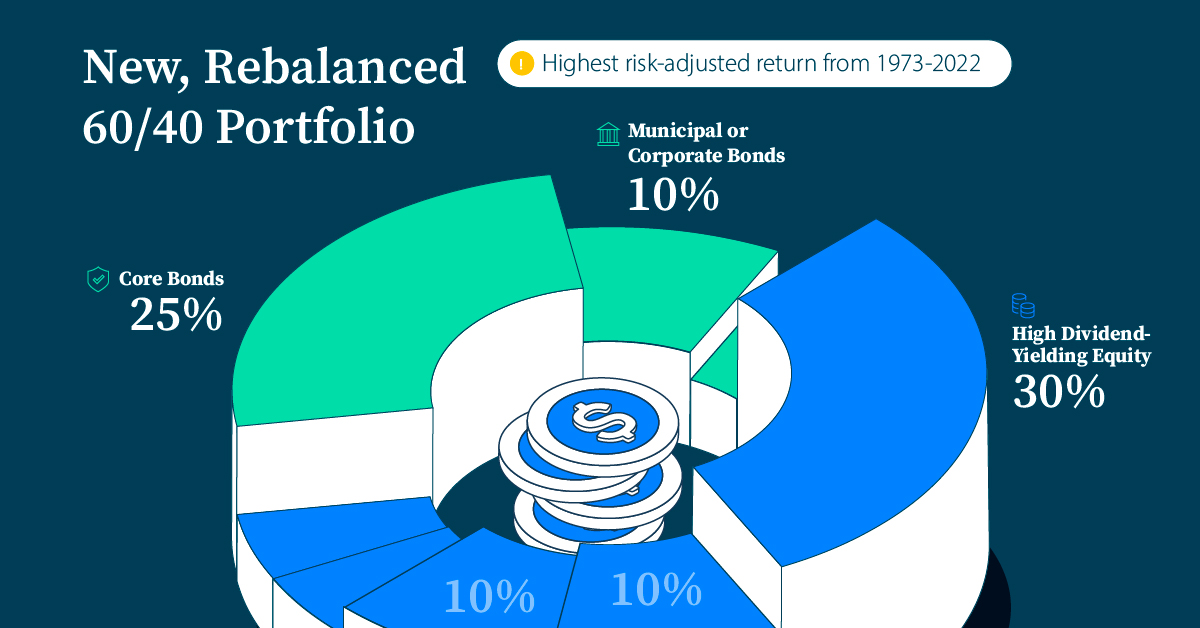

If youre looking to enhance the diversity of your high-dividend portfolio, consider adding a mix of different sectors and industries. By spreading your investments across various sectors, you can reduce the risk of being heavily affected by a downturn in any one industry.

Additionally, including a combination of growth-oriented and income-oriented stocks can provide a balance of stability and potential for capital appreciation. By diversifying your portfolio in this way, you can build a more resilient and potentially higher-yielding investment strategy for the long term.

Conclusion

In conclusion, building a high-dividend yield portfolio requires careful selection of assets that offer consistent and substantial returns. By focusing on high dividend stocks, investors can potentially earn regular income while also benefiting from capital appreciation.

Diversification, due diligence, and a long-term investment horizon are essential components of constructing a successful high-dividend yield portfolio. With the right strategy and a commitment to monitoring and adjusting the portfolio over time, investors can create a reliable source of passive income and achieve their financial goals.